Scholium Group plc

Interim Report & Financial Statements

15 December 2014

Scholium Group plc (“Scholium” or the “Company” or, together with its subsidiaries, the “Group”) is pleased to present its interim report and financial statements for the six months ended 30 September 2014. The Group is involved in the trading of rare and collectible items.

Operational Highlights

· Important and high quality stock acquired by Shapero Rare Books to drive sales for the principal selling season in the second half of the financial year

· Launch of Shapero Modern, the modern and contemporary prints gallery within Shapero Rare Books

· Trade commencement and development of the Scholium Trading proposition

· Continued performance of South Kensington Books and accelerated growth of Ultimate Library

Financial Highlights

· Revenue of £2.80 million (2013: £2.74 million)

· Gross Profit of £1.14 million (2013: £1.16 million)

· EBITDA of -£0.18 million (2013: £0.27 million)

· Stock of £6.60 million (2013: £3.9 million)

· NAV/Share of 77.49p1

· Interim dividend of 0.5p per ordinary share payable to shareholders on the company’s register on 16 January 2015.

1Based on the currently issued share capital

Commenting on the interim results Philip Blackwell, Chief Executive of the Group, noted “We have spent the first six months of our financial year acquiring new stock, using much of the sum raised on flotation in March this year and executing our strategy. Shapero has significantly increased its range of high quality stock which puts it in a strong position for the significant selling season which occurs in the second half of the financial year. The new Scholium Trading business has launched and made its first acquisitions and our Kensington operations continue to perform strongly.”

For further information, please contact:

|

Scholium Group plc

Philip Blackwell, Chief Executive Officer

Simon Southwood, Chief Financial Officer

|

+44 (0)20 7493 0876

|

|

WH Ireland Ltd – Nominated Adviser

Chris Fielding / Mark Leonard

|

+44 (0)20 7220 1666

|

|

Whitman Howard Ltd – Broker

Ranald McGregor-Smith / Niall Devins

|

+44 (0)20 7087 4550

|

Business Review

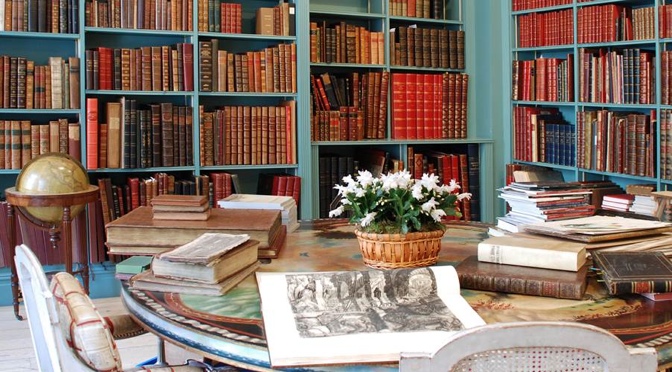

Scholium Group companies are involved primarily in the trading and retailing of books and other works on paper, as well as dealing in rare and collectible items in the wider art market.

The group of businesses comprises:

• Shapero Rare Books, a dealer in rare and antiquarian books and works on paper, located in Mayfair, London;

• South Kensington Books, a bookshop specialising primarily in art, and its sister business, Ultimate Library, which creates bespoke libraries for luxury hotels and private residences; and

• Scholium Trading, a company set up to trade in conjunction with other dealers in high value rare and collectible items.

Revenue Streams

The Group earns revenue from:

• the sale of rare books and works on paper through Shapero Rare Books;

• the sale of art books and literature through South Kensington Books;

• the sale of whole collections and libraries through Ultimate Library; and

• the sale of other rare and collectible items through Scholium Trading.

Key objectives and key performance indicators (KPIs)

The Group’s strategy is to:

• increase the antiquarian stock and trade of Shapero Rare Books and broaden the product mix into Modern prints;

• invest in developing Scholium Trading – a company created to trade alongside other dealers in high value rare and collectible items and participate in the acquisition for sale of large consignments; and

• accelerate the growth of the South Kensington Books and Ultimate Library brands; the latter concomitant with the development of international hospitality groups and the demand for premium property in Central London.

The directors intend to provide an attractive level of dividends to shareholders along with stable asset-backed growth driven by the markets in which the Group operates.

Our current principal KPIs are:

• gross margin, EBITDA, earnings per share;

• the breadth and distribution of the stock of assets held by the Group;

• stock turnover of assets; and

• various key risk indicators including capital resources, portfolio allocation and cash.

Performance Review

Overall Performance

The table below illustrates performance for the first six months of our financial year. Overall, revenue has increased, gross margin on owned stock has increased, but due to the change in mix between commission and owned stock the gross margin of the Group has decreased. The restocking exercise of Shapero Rare Books has been continuing apace and the business is in a good position for the second half of the financial year, which contains the main selling season. Costs have increased – primarily to manage the enhanced stock levels and due to the increased overhead of the AIM listing. The balance sheet remains strong with a very high level of asset backing. Our challenge is to justify the increased overhead by converting the increased stock into profitable sales in the second half of the financial year.

Figure 1.: Overall Performance (all figures £,000 unless otherwise noted)

|

Six months ended September

|

|

|

2014

|

2013

|

Variance

|

|

Revenue

|

2,798

|

2,739

|

2.2%

|

|

Gross Profit

|

1,142

|

1,161

|

-1.6%

|

|

Gross Margin

|

41%

|

42%

|

-2.4%

|

|

Direct Costs

|

(168)

|

(159)

|

5.7%

|

|

Administration Costs

|

(1,184)

|

(767)

|

54.4%

|

|

EBITDA

|

(184)

|

269

|

-168.4%

|

|

|

|

|

|

Stock

|

6,605

|

3,880

|

70.2%

|

|

Cash

|

2,754

|

50

|

|

|

Net Asset Value

|

10,538

|

1,274

|

|

|

NAV/Share

|

77.49p

|

|

|

Shapero Rare Books

Whilst activity at Shapero Rare Books in the first six months of the financial year has been slightly quieter than anticipated, the focus of the business has been to position itself strongly for the major selling season which runs in the second half of the financial year, culminating with The European Fine Art Fair in March. Consistent with these goals, Shapero Rare Books has increased its stock significantly to approximately £6.3 million at 30 September 2014 (2013: £3.8 million) with a number of noteworthy acquisitions. As expected with the move to more expensive, higher quality stock, the margin on sales of owned stock increased to approximately 37.6% (2013: 34.8%). Shapero Rare Books has also become more active in the sale of modern prints.

Figure 2.: Shapero Rare Books KPIs (all figures £,000 unless otherwise noted)

|

Six months ended September

|

Variance

|

|

Revenue

|

2014

|

2013

|

|

|

Own Stock

|

2,370

|

2,207

|

7.4%

|

|

Commission

|

25

|

240

|

-89.6%

|

|

2,395

|

2,447

|

-2.1%

|

|

Gross Profit

|

|

|

|

|

Own Stock

|

890

|

769

|

15.7%

|

|

Commission

|

25

|

240

|

-89.6%

|

|

915

|

1,009

|

-9.3 %

|

|

Gross Margin

|

|

|

|

|

Own Stock

|

37.6%

|

34.8%

|

|

|

Own stock + Commission

|

38.2%

|

41.2%

|

|

|

|

|

|

|

EBITDA

|

-1

|

239

|

–100.4%

|

|

|

|

|

|

Stock Value

|

6,274

|

3,779

|

66.0%

|

|

|

|

|

The most significant variance during the period under review was the absence of a one-off commission that the business earned during the first half of the financial year of 2013 on the final sale of a large consignment of books. The cost base of Shapero Rare Books has increased to reflect the increased purchasing activity and anticipated sales activity in the second half of the financial year.

Whilst stock turnover for the period is lower, this is in large part due to the rapid growth in stock; and positions the business strongly for the second half of the financial year.

South Kensington Operations

Our South Kensington operations have shown accelerated growth in sales, margin and profitability and are strongly cash positive. Increased footfall has helped retail sales and some high profile hotel contract wins, both in London and overseas, have also driven sales.

Figure 3.: South Kensington Operations Summary (all figures £,000 unless otherwise noted)

|

South Kensington Operations

|

Six months ended September

|

Growth

|

|

Revenue

|

2014

|

2013

|

|

|

South Kensington Bookshop

|

276

|

259

|

6.6%

|

|

Ultimate Library

|

116

|

33

|

251.5%

|

|

392

|

292

|

34.2%

|

|

|

|

|

|

Gross Profit

|

217

|

149

|

45.6%

|

|

Gross Margin

|

55%

|

51%

|

|

|

|

|

|

|

EBITDA

|

60

|

30

|

100%

|

Trade in the bookshop showed 6% year-on-year growth and we were most encouraged by growth in orders to Ultimate Library.

Scholium Trading

The first half of the year was productive for Scholium Trading. Although this activity began more slowly than anticipated, it has been pleasing to note that the stock turn on trades completed has been better than expected. Scholium Trading earned its first profit in the period under review, with a return of 10% over a period of 2 months. Since the period end, two further profitable sales have been completed. Having spent considerable time developing relationships with dealers, we are seeing increased activity in the second half of the year with some material propositions for acquiring significant collections.

Financial Position and Cashflow

On 30 September 2014 the Group had a strong balance sheet – £2.75 million of cash (30 September 2013: £0.05 million) and a further £6.6 million of stock (30 September 2014: £3.9 million) supported Gross Assets of £11.5 million (30 September 2013: £5.6 million). The company had no debt; all working capital facilities provided by the group’s shareholders in 2012 and 2013 were repaid over the period (a total amount of £0.53 million).

Outlook

Whilst sales to date have been slightly lower than hoped for, the overall result for our financial year is heavily influenced by the outcome of sales in the final quarter, which culminates in The European Fine Art Fair, where, traditionally, a significant proportion of the Group’s sales are made. Given the high levels of quality stock and a firm pipeline of selling opportunities, the Directors are confident, if certain high value items are successfully sold before the end of March 2015, that market forecasts will be achieved.

Dividend

Based on the directors’ assessment of the prospects for the year as a whole, the Company will pay an interim dividend of 0.5p to shareholders on the Company’s register on 16 January 2015.

Key Risks

Like all businesses, the Group faces risks and uncertainties that could impact on the Group’s strategy. The Board recognizes that the nature and scope of these risks can change and regularly reviews the risks faced by the Group and the systems and processes to mitigate such risks.

The principal risks and uncertainties affecting the continuing business activities of the Group were outlined in detail in the Strategic Report section of the annual report covering the year ended 31March 2014.

In preparing this interim report for the six months ended 30 September 2014, the Board has reviewed these risks and uncertainties and considers that there have been no changes since the publication of the 2014 Annual Report.

Philip Blackwell

12 December 2014

Independent Review Report to Scholium Group plc

Introduction

We have been engaged by the company to review the condensed set of financial statements in the interim report for the six months ended 30th September 2014 which comprises the condensed consolidated statement of comprehensive income, the consolidated statement of changes in equity, the condensed consolidated statement of financial position and the consolidated statement of cash flows and the related explanatory notes. We have read the other information contained in the interim report and considered whether it contains any apparent misstatements or material inconsistencies with the information in the condensed set of financial statements.

This report is made solely to the company in accordance with the terms of our engagement. Our review has been undertaken so that we might state to the company those matters we are required to state to it in this report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company for our review work, for this report, or for the conclusions we have reached.

Directors’ Responsibilities

The interim report is the responsibility of, and has been approved by, the directors. The directors are responsible for preparing the interim report in accordance with the AIM rules.

As disclosed in note 2, the annual financial statements of the Group are prepared in accordance with IFRSs as adopted by the EU. The condensed set of financial statements included in this interim report has been prepared in accordance with the recognition and measurement requirements of IFRSs as adopted by the EU.

Our Responsibility

Our responsibility is to express to the company a conclusion on the condensed set of financial statements in the interim report based on our review.

Scope of Review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410 Review of Interim Financial Information Performed by the Independent Auditor of the Entity issued by the Auditing Practices Board for use in the UK. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the interim report for the six months ended 30th September 2014 is not prepared, in all material respects, in accordance with the recognition and measurement requirements of IFRSs as adopted by the EU and the AIM rules.

A K Bahl BA FCA

For and on behalf of

Wenn Townsend Chartered Accountants

Oxford, United Kingdom

12 December 2014

Consolidated statement of comprehensive incomefor the six-month period ended 30 September 2014 (unaudited)

|

|

|

Six-month period

ended

|

Six-month period

ended

|

Year

ended

|

|

|

|

30 September

|

30 September

|

31 March

|

|

|

|

2014

|

2013

|

2014

|

|

|

Note

|

£000

|

£000

|

£000

|

|

|

|

|

|

|

|

Revenue

|

3

|

2,798

|

2,739

|

6,733

|

|

Cost of sales

|

|

(1,656)

|

(1,578)

|

(3,954)

|

|

Gross profit

|

|

1,142

|

1,161

|

2,779

|

|

|

|

|

|

|

|

Distribution expenses

|

|

(168)

|

(159)

|

(423)

|

|

|

|

|

|

|

|

Administrative expenses

|

|

(1,184)

|

(767)

|

(1,802)

|

|

Exceptional items:

|

|

|

|

|

|

Share-based payment schemes

|

|

(19)

|

–

|

(385)

|

|

IPO expenses

|

|

–

|

–

|

(228)

|

|

Total administrative expenses

|

|

(1,203)

|

(767)

|

(2,415)

|

|

|

|

|

|

|

|

(Loss)/profit from operations

|

|

(229)

|

235

|

(59)

|

|

|

|

|

|

|

|

Adjusted profit from operations before IPO expenses and share-based payment expense

|

|

(210)

|

–

|

554

|

|

Share-based payment schemes

|

|

(19)

|

–

|

(385)

|

|

IPO expenses

|

|

–

|

–

|

(228)

|

|

(Loss)/profit from operations

|

|

(229)

|

235

|

(59)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income

|

|

–

|

–

|

1

|

|

Financial expenses

|

|

(6)

|

(128)

|

(290)

|

|

|

|

|

|

|

|

(Loss)/profit before taxation

|

|

(235)

|

107

|

(348)

|

|

|

|

|

|

|

|

Income tax credit/(expense)

|

4

|

47

|

189

|

251

|

|

|

|

|

|

|

|

(Loss)/profit for the year and total comprehensive income attributable to equity holders of the parent company

|

|

(188)

|

296

|

(97)

|

|

|

|

|

|

|

|

Basic (loss)/profit per share – pence

|

5

|

(1.40)

|

347.14

|

(36.49)

|

|

|

|

|

|

|

|

Diluted (loss)/profit per share – pence

|

5

|

(1.40)

|

5.91

|

(36.49)

|

|

Consolidated statement of financial position

|

|

|

|

30 September

|

30 September

|

31 March

|

|

|

|

2014

|

2013

|

2014

|

|

|

Note

|

£000

|

£000

|

£000

|

|

Assets

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

Property, plant and equipment

|

|

115

|

115

|

104

|

|

Intangible assets

|

|

12

|

20

|

16

|

|

Deferred taxation

|

|

305

|

189

|

258

|

|

|

|

432

|

324

|

378

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

Stock

|

|

6,605

|

3,880

|

4,667

|

|

Trade and other receivables

|

6

|

1,716

|

1,374

|

1,816

|

|

Cash and cash equivalents

|

|

2,754

|

50

|

7,578

|

|

|

|

11,075

|

5,304

|

14,061

|

|

|

|

|

|

|

|

Total assets

|

|

11,507

|

5,628

|

14,439

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

Trade and other payables

|

7

|

962

|

1,616

|

3,111

|

|

Loans and borrowings

|

|

–

|

623

|

533

|

|

Current corporation tax liabilities

|

|

7

|

7

|

14

|

|

Total current liabilities

|

|

969

|

2,246

|

3,658

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

Loans and borrowings

|

|

–

|

2,108

|

–

|

|

|

|

–

|

2,108

|

–

|

|

|

|

|

|

|

|

Total liabilities

|

|

969

|

4,354

|

3,658

|

|

|

|

|

|

|

|

Net assets

|

|

10,538

|

1,274

|

10,781

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity and liabilities

|

|

|

|

|

|

Equity attributable to owners of the Company

|

|

|

|

|

|

Ordinary shares

|

|

136

|

52

|

132

|

|

Share premium

|

|

9,516

|

–

|

9,458

|

|

Merger reserve

|

|

82

|

2,047

|

82

|

|

Retained earnings/(deficit)

|

|

804

|

(825)

|

1,109

|

|

Total equity

|

|

10,538

|

1,274

|

10,781

|

These interim financial statements were approved by the Board of Directors on 12 December 2014 and signed on its behalf by Simon Southwood