Scholium Group plc

Interim report and Financial Statements

9 December 2015

The directors of Scholium Group plc (“Scholium”, the “Company” or, together with its subsidiaries, the “Group”) present their report and financial statements for the company for the six months ended 30 September 2015.

Financial Highlights

- Revenue of £3.3 million (2014: £2.4 million) up 38.0%

- Gross profit of £1.1 million (2014: £0.9 million) up 19.7%

- EBITDA[1] of £45k (2014: -£215k)

- Return to profitability in our continuing businesses

Operational Highlights

- Careful management of costs

- Development of Shapero Rare Books and Shapero Modern Brands

- Scholium Trading increasingly recognised in the industry

- Completion of the sale of South Kensington business, a retailer of modern books

Jasper Allen, Chairman of Scholium, noted “The international political instability of the last twelve months which impacted a number of established customers created a challenge for the management team, but we are delighted that they have responded admirably and managed to reposition stock, increase revenue and gross profits, reduce the cost base and return the business to operational profitability. The performance of the business over the first six months and the start of the second half is encouraging and we look forward to the prospects of the second half of the year.”

For further information, please contact

| Scholium Group plc

Jasper Allen, Chairman Simon Southwood, Finance Director |

+44 (0) 20 7493 0876 |

| WH Ireland (Nomad & Broker)

Chris Fielding/Mark Leonard |

+44 (0) 20 7220 1666 |

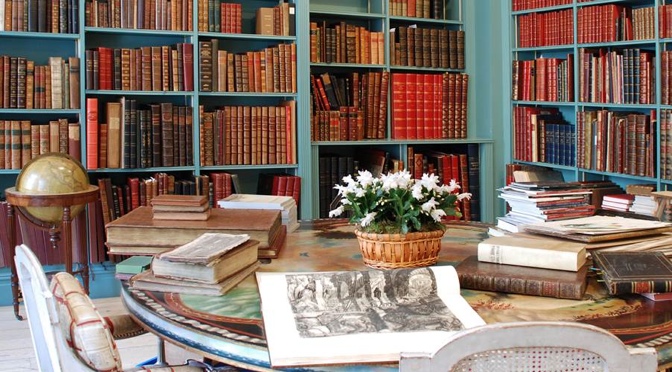

Business Review

Scholium Group companies are involved primarily in the trading and retailing of books and other works on paper, as well as dealing in rare and collectible items in the wider art market.

The group of businesses comprises:

- Shapero Rare Books, a dealer in rare and antiquarian books and works on paper, located in Mayfair, London; and

- Scholium Trading, a company set up to trade in conjunction with other dealers in high value rare and collectible items.

Revenue Streams

The Group earns revenue from:

- the sale of rare books and works on paper through Shapero Rare Books; and

- the sale of other rare and collectible items through Scholium Trading.

Key objectives and key performance indicators (KPIs)

The Group’s strategy is to:

- maintain the antiquarian stock and grow the trade of Shapero Rare Books including development of its Modern prints department; and

- continue to develop Scholium Trading by trading alongside other dealers in high value, rare and collectible items and by participating in the acquisition for onward sale of large consignments.

The directors intend to provide an attractive level of dividends to shareholders along with stable asset-backed growth driven by the markets in which the Group operates.

Our current principal KPIs are:

- gross margin, EBITDA, earnings per share;

- the breadth and distribution of the stock of assets held by the Group;

- stock turnover; and

- various key risk indicators including capital resources, portfolio allocation and cash.

Performance Review

Overall Performance

The Group has shown a 38% growth in revenue and, concomitantly with careful management of costs, has shown an encouraging return to profitability for the continuing businesses.

The Group has benefitted from the sale, completed in April 2015, of the South Kensington business as well as the decision to diversify the Group’s stock into areas that are less susceptible to international political risk; and Scholium Trading is starting to generate the type of return we intended.

The comparative figures for the six months ended 30 September 2014 presented below have been restated to exclude the contribution of the former South Kensington business. This enables a truer like for like comparison to be made.

In the six months under review, the team at Shapero Rare Books successfully repositioned the stock in order to focus it on areas which are thought to be more resilient and of greater interest to the newer generation of book collectors, whilst not forgetting the Group’s traditional expertise in Travel, Natural History and Russian materials. This exercise led to the sale of some of the stock at lower margins than normal, but will be of greater benefit to the business in the future.

The two newer activities in the Group — Shapero Modern, which sells modern prints, and Scholium Trading are also beginning to show signs that early expectations can be met: they contributed 7.1% and 13.5% to Group turnover respectively.

At the operational level, the business was profitable for the first six months, helped significantly by more careful expenditure on marketing in Shapero Rare Books and management of Central Costs.

- Overall Performance (all figures £000 unless otherwise noted)

| Six months ended September | Variance | |||

| 2015 | 2014 (Restated) | |||

| Revenue | 3,320 | 2,406 | 38.0% | |

| Gross Profit | 1,107 | 925 | 22.2% | |

| Gross Margin | 33.3% | 38.4% | -5.1% | |

| Direct Costs | (116) | (160) | -27.5% | |

| Administration Costs | (961) | (1,002) | -4.1% | |

| EBITDA | 45 | (215) | ||

| Stock | 7,420 | 6,488 | ||

| Cash | 1,619 | 2,634 | ||

| Net Asset Value | 10,159 | 10,538 | ||

| NAV/Share (pence) | 74.70 | 78.65 | ||

The table below breaks down performance of the group by department. The growth in contribution by Scholium Trading is notable, as well as the management of unallocated costs, which are largely made up of central costs and group overhead.

- Breakdown of EBITDA by Department (all figures £’000)

| Six months ended September | Variance | |||

| 2015 | 2014 (Restated) | |||

| Revenue | ||||

| Shapero Rare Books | 2,857 | 2,395 | 19.3% | |

| Scholium Trading | 463 | 11 | ||

| 3,320 | 2,406 | 38.0% | ||

| EBITDA | ||||

| Shapero Rare Books | 86 | (1) | ||

| Scholium Trading | 147 | 5 | ||

| Unallocated | (188) | (219) | ||

| 45 | (215) | |||

Shapero Rare Books

In the first six months of the financial year, the focus of the business was to grow sales and profitability with a view to moving part of the stock and trade of Shapero Rare Books into areas which are more attractive for the modern collector. This drive to increase sales paid off and the business is well positioned for the second half of the financial year. Gross Profit has increased in the division at the expense of the gross margin which was 33.1% as compared to 37.6% for the equivalent period in the 2014/15 financial year. The modern prints department continues to perform to expectations.

- Shapero Rare Books KPIs (all figures £’000 unless otherwise noted)

| Six months ended September | Variance | |||

| Revenue | 2015 | 2014 | ||

| Own Stock | 2,846 | 2,370 | 20.1% | |

| Commission | 11 | 25 | -56.0% | |

| 2,857 | 2,395 | |||

| Gross Profit | ||||

| Own Stock | 941 | 890 | 5.7% | |

| Commission | 11 | 25 | -56.0% | |

| 952 | 915 | |||

| Gross margin | ||||

| Own Stock | 33.1% | 37.6% | ||

| Own Stock + Commission | 33.3% | 38.2% | ||

| EBITDA | 86 | (1) | ||

| Stock Value | 6,911 | 6,274 | 10.1% | |

Scholium Trading

Scholium Trading trades alongside other third party dealers in rare and collectible goods. We were encouraged by the performance of the division over the period as it generated a gross profit of £155k from c. £308k of stock (ROI ranging from 5.7% to 137.1%). At the period end the division held £509k of stock alongside five third-party dealers.

- Scholium Trading KPIs (all figures £000 unless otherwise noted)

| Six months ended September | |||

| 2015 | 2014 | ||

| Revenue | |||

| Own Stock | 463 | – | |

| Commission | 0 | 11 | |

| 463 | 11 | ||

| Gross Profit | |||

| Own Stock | 155 | – | |

| Commission | 0 | 11 | |

| 155 | 11 | ||

| Gross Margin | |||

| Own Stock + Commission | 33.4% | 100.0% | |

| EBITDA contribution | 147 | 5 | |

| Stock Value | 509 | 214 | |

Financial Position & Cashflow

The group remains very well capitalised. On 30 September 2015 the Group had a strong balance sheet with cash balances of £1.62 million (30 September 2014: £2.63 million) and stock of £7.4 million (30 September 2014: £6.5 million). These supported Net Assets of £10.2 million (30 September 2014: £10.5 million). The Group had no debt but has a £0.5 million facility with Coutts.

Outlook

The international political instability of the last twelve months which impacted a number of established customers created a challenge for the management team, but we are delighted that they have responded admirably and managed to reposition stock, increase revenue and gross profits, reduce the cost base and return the business to operational profitability. The performance of the business over the first six months and the start of the second half is encouraging and we look forward to the prospects of the second half of the year.

Key Risks

Like all businesses, the Group faces risks and uncertainties that could impact on the Group’s strategy. The Board recognizes that the nature and scope of these risks can change and regularly reviews the risks faced by the Group and the systems and processes to mitigate such risks.

The principal risks and uncertainties affecting the continuing business activities of the Group were outlined in detail in the Strategic Report section of the annual report covering the year ended 31 March 2015.

In preparing this interim report for the six months ended 30 September 2015, the Board has reviewed these risks and uncertainties and considers that there have been no changes since the publication of the 2015 Annual Report.

Independent Review Report to Scholium Group plc

Introduction

We have been engaged by the company to review the condensed set of financial statements in the interim report for the six months ended 30th September 2015 which comprises the condensed consolidated statement of comprehensive income, the consolidated statement of changes in equity, the condensed consolidated statement of financial position and the consolidated statement of cash flows and the related explanatory notes. We have read the other information contained in the interim report and considered whether it contains any apparent misstatements or material inconsistencies with the information in the condensed set of financial statements.

This report is made solely to the company in accordance with the terms of our engagement. Our review has been undertaken so that we might state to the company those matters we are required to state to it in this report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company for our review work, for this report, or for the conclusions we have reached.

Directors’ Responsibilities

The interim report is the responsibility of, and has been approved by, the directors. The directors are responsible for preparing the interim report in accordance with the AIM rules.

As disclosed in note 2, the annual financial statements of the Group are prepared in accordance with IRFSs as adopted by the EU. The condensed set of financial statements included in this interim report has been prepared in accordance with the recognition and measurement requirements of IFRSs as adopted by the EU.

Our Responsibility

Our responsibility is to express to the company a conclusion on the condensed set of financial statements in the interim report based on our review.

Scope of Review

We conducted our review in accordance with International Standard on Review Engagements (UK and Ireland) 2410 Review of Interim Financial Information Performed by the Independent Auditor of the Entity issued by the Auditing Practices Board for use in the UK. A review of interim financial information consists of making enquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing (UK and Ireland) and consequently does not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the condensed set of financial statements in the interim report for the six months ended 30th September 2015 is not prepared, in all material respects, in accordance with the recognition and measurement requirements of IFRSs as adopted by the EU and the AIM rules.

A K Bahl BA FCA

For and on behalf of Wenn Townsend

Chartered Accountants

Oxford

United Kingdom

8 December 2015

Consolidated statement of total comprehensive income (unaudited)

| Six-month | Six-month | Year | ||

| period ended | period ended | ended | ||

| (Unaudited) | (Unaudited) | (Audited) | ||

| Restated | ||||

| 30 Sept | 30 Sept | 31 Mar | ||

| 2015 | 2014 | 2015 | ||

| Note | £000 | £000 | £000 | |

| Revenue | 3 | 3,320 | 2,406 | 5,166 |

| Cost of Sales | (2,213) | (1,481) | (3,273) | |

| Gross profit | 1,107 | 925 | 1,893 | |

| Distribution costs | (116) | (160) | (268) | |

| Administrative expenses | (961) | (1,002) | (2,148) | |

| Exceptional items: | ||||

| Loss of office | 4 | (24) | – | – |

| Share-based payment schemes | – | (19) | – | |

| Total administrative expenses | (985) | (1,021) | (2,148) | |

| Profit/(Loss) from operations | 6 | (256) | (523) | |

| Financial income | 1 | – | – | |

| Financial expenses | (1) | (6) | (6) | |

| Profit/(loss) before taxation | 6 | (262) | (529) | |

| Income tax credit/(expense) | 5 | – | 47 | 29 |

| Profit/(Loss) for the year from continuing operations | 6 | (215) | (500) | |

| Discontinued operations | ||||

| Profit for the year from discontinued operations | – | 27 | 24 | |

| Profit/(loss) on sale of discontinued operations | 6 | (10) | – | – |

| Profit/(Loss) for the year and total comprehensive income attributable to equity holders of the parent company | (4) | (188) | (476) | |

| Basic and diluted profit/(loss) per share: | ||||

| From continuing operations – pence | 7 | 0.04 | (1.60) | (3.71) |

| From discontinued operations – pence | (0.07) | 0.20 | 0.18 | |

| Total Diluted (loss)/profit per share – pence | (0.03) | (1.40) | (3.53) |

Consolidated statement of financial position

| 30 Sept | 30 Sept | 31 Mar | ||

| 2015 | 2014 | 2015 | ||

| £000

(unaudited) |

£000

(unaudited) |

£000

(audited) |

||

| Assets | ||||

| Non-current assets | ||||

| Property, plant and equipment | 79 | 108 | 92 | |

| Deferred corporation tax asset | 280 | 305 | 280 | |

| 359 | 413 | 372 | ||

| Current assets | ||||

| Inventories | 7,420 | 6,488 | 7,471 | |

| Trade and other receivables | 8 | 1,890 | 1,866 | 1,694 |

| Cash and cash equivalents | 1,619 | 2,634 | 2,122 | |

| 10,929 | 10,988 | 11,287 | ||

| Assets of disposal group classified as held for sale | – | 327 | 162 | |

| Total assets | 11,288 | 11,728 | 11,821 | |

| Current liabilities | ||||

| Trade and other payables | 9 | 1,129 | 882 | 1,634 |

| Current corporation tax liabilities | – | 7 | – | |

| Total current liabilities | 1,129 | 889 | 1,634 | |

| Liabilities of disposal group classified as held for sale | – | 301 | 24 | |

| Total liabilities | 1,129 | 1,190 | 1,658 | |

| Net assets | 10,159 | 10,538 | 10,163 | |

| Equity and liabilities | ||||

| Equity attributable to owners of the parent | ||||

| Ordinary shares | 136 | 136 | 136 | |

| Share Premium | 9,516 | 9,516 | 9,516 | |

| Merger reserve | 82 | 82 | 82 | |

| Retained earnings | 425 | 804 | 429 | |

| Total equity | 10,159 | 10,538 | 10,163 |

These interim financial statements were approved by the Board of Directors on 8 December 2015 and signed on its behalf by Simon Southwood

Statement of changes in equity |

Share | Share | Merger | Retained | Total | |

| Capital | Premium | Reserve | earnings | equity | ||

| £000 | £000 | £000 | £000 | £000 | ||

| Balance at 1 Apr 2014 | 132 | 9,458 | 82 | 1,109 | 10,781 | |

| Loss for the period | – | – | – | (188) | (188) | |

| Total comprehensive income for the period | – | – | – | (188) | (188) | |

| Shares issued in the period | 4 | 58 | 62 | |||

| Share-based payments | 19 | 19 | ||||

| Dividends paid | (136) | (136) | ||||

| Total contributions by owners of the parent | 4 | 58 | (117) | (55) | ||

| Balance at 30 Sept 2014 | 136 | 9,516 | 82 | 804 | 10,538 | |

| Profit/(loss) for the period | – | – | – | (375) | (375) | |

| Total comprehensive income for the period | – | – | – | – | – | |

| Shares issued in the period | ||||||

| Share issue expenses | – | – | – | – | – | |

| Share-based payments | – | – | – | – | – | |

| Total contributions by owners of the parent | – | – | – | – | – | |

| Balance at 31 March 2015 | 136 | 9,516 | 82 | 429 | 10,163 | |

| Balance at 1 Apr 2015 | 136 | 9,516 | 82 | 429 | 10,163 | |

| Profit/(loss) for the period | – | – | – | (4) | (4) | |

| Total comprehensive income for the period | – | – | – | (4) | (4) | |

| Shares issued in the period | ||||||

| Share-based payments | – | – | – | – | ||

| Dividends paid | – | – | – | – | – | |

| Total contributions by owners of the parent | – | – | – | – | – | |

| Balance at 30 September 2015 | 136 | 9,516 | 82 | 425 | 10,159 |

Consolidated statement of cash flows |

||||

| 30 Sept | 30 Sept | 31 Mar | ||

| 2015 | 2014 | 2015 | ||

| £000 | £000 | £000 | ||

| Cash flows from operating activities | ||||

| (Loss)/profit before tax | (4) | (235) | (505) | |

| Depreciation of property, plant and equipment | 15 | 22 | 44 | |

| Amortisation of intangible assets | – | 4 | 8 | |

| (Profit)/loss on disposal of discontinued operation | 18 | – | – | |

| Interest payable | – | 6 | – | |

| Share-based payment credit | – | 19 | – | |

| 29 | (184) | (453) | ||

| Decrease/(increase) in inventories | 51 | (1,938) | (2,930) | |

| Decrease/(increase) in trade and other receivables | (196) | 100 | 102 | |

| Increase/(decrease) in trade and other payables | (505) | (2,156) | (1,639) | |

| Net cash generated from operating activities | (621) | (4,178) | (4,920) | |

| Cash flows from investing activities | ||||

| Purchase of property, plant and equipment | (2) | (33) | (38) | |

| Interest received | – | – | – | |

| Disposal of discontinued operation | 120 | – | – | |

| Net cash used in investing activities | 118 | (33) | (38) | |

| Cash flows from financing activities | ||||

| Proceeds from the issuance of ordinary shares | – | 62 | 62 | |

| Share issue expenses | – | – | – | |

| (Repayment)/receipt of shareholder loans | – | (533) | (350) | |

| Dividends paid | – | (136) | (204) | |

| Interest paid | – | (6) | (6) | |

| Net cash (used)/generated from financing activities | – | (613) | (498) | |

| Net increase/(decrease) in cash and cash equivalents | (503) | (4,824) | (5,456) | |

| Cash and cash equivalents at the beginning of the year | 2,122 | 7,578 | 7,578 | |

| Cash and cash equivalents at the end of the year | 1,619 | 2,754 | 2,122 | |

| Cash and cash equivalents- continuing operations | 1,619 | 2,634 | 2,122 | |

| Cash and cash equivalents- discontinued operations | 120 | |||

| 1,619 | 2,754 | 2,122 | ||

- General information

Scholium Group plc and its subsidiaries (together ‘the Group’) are engaged in the trading and retailing of rare and antiquarian books and works on paper primarily in the United Kingdom. The Company is a public company domiciled and incorporated in England and Wales (registered number 08833975). The address of its registered office is 32 St George Street, London W1S 2EA.

- Basis of preparation

These condensed interim financial statements of the Group for the six months ended 30 September 2015 (the ‘Period’) have been prepared using accounting policies consistent with International Financial Reporting Standards (IFRSs) as adopted by the European Union. The same accounting policies, presentation and methods of computation are followed in the condensed set of financial statements as applied in the Group’s latest audited financial statements for the year ended 31 March 2015. Amendments made to IFRSs since 31 March 2015 have not had a material effect on the Group’s results or financial position for the six-month period ended 30 September 2015. While the financial figures included within this half-yearly report have been computed in accordance with IFRSs applicable to interim periods, this half-yearly report does not contain sufficient information to constitute an interim financial report as set out in International Accounting Standard 34 Interim Financial Reporting. These condensed interim financial statements have not been audited, do not include all of the information required for full annual financial statements, and should be read in conjunction with the Group’s consolidated annual financial statements for the year ended 31 March 2015. The auditors’ opinion on these Statutory Accounts was unqualified, did not draw attention to any matters by way of emphasis and did not contain a statement under s498(2) or s498(3) of the Companies Act 2006.

- Revenue

| 30 Sept | 30 Sept | 31 Mar | ||

| 2015 | 2014 | 2015 | ||

| £000 | £000 | £000 | ||

| Book Sales | 3,309 | 2,369 | 5,057 | |

| Commissions | 11 | 25 | 81 | |

| Other income | – | 12 | 28 | |

| 3,320 | 2,406 | 5,166 |

- Exceptional items

The group settled a sum of £24,000 on Philip Blackwell in compensation for his loss of office.

- Income Tax

| 30 Sept | 30 Sept | 31 Mar | |||

| 2015 | 2014 | 2015 | |||

| £000 | £000 | £000 | |||

| Current tax (credit)/expense | |||||

| Current tax | – | 1 | (7) | ||

| Deferred tax | |||||

| Origination and reversal of temporary differences | – | (48) | (22) | ||

| Total tax expense | – | (47) | (29) | ||

| Attributable to continuing operations | – | (47) | (29) | ||

| Attributable to discontinuing operations | – | ||||

| Total tax expense | – | (47) | (29) | ||

The charge for the year can be reconciled to the profit/(loss) per the income statement as follows:

| 30 Sept | 30 Sept | 31 Mar | |||

| 2015 | 2014 | 2015 | |||

| £000 | £000 | £000 | |||

| Profit/(loss) before tax | (4) | (235) | (505) | ||

| Applied corporation tax rates: | 20.00% | 20.00% | 20.00% | ||

| Tax at the UK corporation tax rate of 20%: | – | (47) | (101) | ||

| Expenses not deductible for tax purposes | – | – | 6 | ||

| Utilisation of previously unrecognised tax losses | – | – | |||

| Origination and reversal of temporary differences | – | – | 66 | ||

| Current tax charge | – | (47) | (29) | ||

- Sale of Discontinued Operations

On 2 April 2015 the Group announced the sale of its South Kensington operations, South Kensington Books and the Ultimate Library, to a company controlled by Philip Blackwell a director of the company, for an aggregate consideration of £137,526. The resulting profit on the sale after the disposal of the assets before professional fees was approximately £6,000 but, after associated legal and professional costs, the sale resulted in a net loss of £10,869.

- Earnings/(Loss) per Share

| Parent undertaking only | 30 Sept | 30 Sept | 31 Mar | ||

| 2015 | 2014 | 2015 | |||

| £000 | £000 | £000 | |||

| Profit/(loss) used in calculating basic and diluted earning per share | 6 | (215) | (500) | ||

| Profit from discontinued operation | (10) | 27 | 24 | ||

| (4) | (188) | (476) | |||

| Number of shares | |||||

| Weighted average number of shares for the purpose of basic and diluted earnings per share | 13,600,000 | 13,399,070 | 13,498,165 | ||

| Basic (loss)/earnings per share from continuing operations (pence per share) | 0.04 | (1.60) | (3.71) | ||

| Basic (loss)/earnings per share from discontinued operations (pence per share) | (0.07) | 0.20 | 0.18 | ||

| Total basic and diluted earnings per share – pence | (0.03) | (1.40) | (3.53) |

Basic earnings per share amounts are calculated by dividing net (loss)/profit for the year or period attributable to ordinary equity holders of the parent by the weighted average number of ordinary shares outstanding during the year.

The Company has 704,000 potentially issuable shares all of which relate to share options issued in the year ended 31 March 2015 all of which have a strike price of 100p per share. As a consequence, the basic and fully diluted number of shares in issue are equal.

No new shares were issued during the period, and the Company had 13.6 million shares in issue at the end of the period.

- Trade and Other Receivables

| 30 Sept | 30 Sept | 31 Mar | |

| 2015 | 2014 | 2015 | |

| £000 | £000 | £000 | |

| Trade debtors | 1,551 | 1,350 | 1,164 |

| Other debtors | 28 | 200 | 221 |

| Prepayments and accrued income | 311 | 316 | 309 |

| 1,890 | 1,866 | 1,694 |

- Trade and Other Payables

| 30 Sept | 30 Sept | 31 Mar | |

| 2015 | 2014 | 2015 | |

| £000 | £000 | £000 | |

| Trade creditors | 754 | 595 | 1,136 |

| Other taxes and social security | 33 | 32 | 37 |

| Accruals and deferred income | 184 | 79 | 363 |

| Other creditors | 158 | 176 | 98 |

| 1,129 | 882 | 1,634 |

[1] Earnings before interest, tax, depreciation and amortization stated for continuing operations before exceptional costs