Scholium Group plc

Annual Report & Financial Statements

7 July 2016

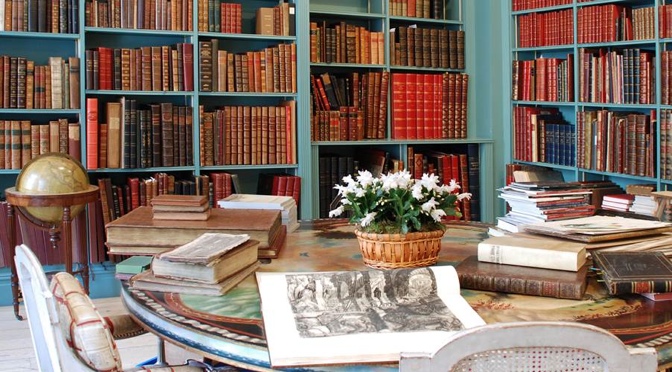

Scholium is engaged in the business of art. Its primary operating subsidiary is Shapero Rare Books which is one of the leading UK and international dealers in rare and antiquarian books and works on paper.

The group also trades alongside other third party dealers in the broader arts and collectibles business via its subsidiary, Scholium Trading.

Operational Highlights

- Stabilisation of performance in core operating areas

- Careful management of cash resources and costs

- Elimination of operating losses

Financial Highlights

| Years Ended 31 March (all figures ‘000) |

2016 |

2015 |

|

| Revenue |

+30.5% |

6,742 |

5,166 |

| Gross Profit |

+25.5% |

2,376 |

1,893 |

| Gross Margin |

-1.4% |

35% |

37% |

| Adjusted Operating Profit[1] |

24 |

(523) |

|

| Cash |

1,309 |

2,122 |

|

| NAV/Share |

74.6p |

74.7p |

Commenting on the results Jasper Allen, Chairman of Scholium, noted “We were pleased with the performance for the year. A significant loss has been reversed and many of our core markets stabilised. There is some evidence of a return in confidence in our Russian customers. Whilst the current year started well, the lead up to the UK referendum on EU membership adversely affected levels of business and we are actively seeking to take advantage of some of the opportunities that will be created.”

| Scholium Group plc

Jasper Allen, Chairman Simon Southwood, Chief Financial Officer |

+44 (0)20 7493 0876 |

| WH Ireland Ltd – Nominated Adviser

Chris Fielding/Mark Leonard |

+44 (0)20 7220 1666 |

Chairman’s Statement

I am very pleased to report, on behalf of your board, that the trend we saw in the first half of the financial year continued through to the second half: the market in our core areas stabilised, and we are actively seeking to take advantage of some of the opportunities that will be created.

The UK referendum on EU membership caused uncertainty in the first trading quarter, but we hope this trend is reversed with a number of new marketing initiatives.

The Group remains well capitalised with strong stock, over £1.3 million in cash and no debt at the year end.

Business Review

The Group’s ambition at the beginning of the financial year was to generate an increased gross return on its assets whilst managing costs in order to bring the group back to profitability. This was achieved.

Sales increased due to greater activity generally both in rare books trading and in our wider trading activities. Shapero Modern made a useful contribution to sales and profits in the year. There has been an increased emphasis on marketing the business more widely.

We have continued to attend the major trade fairs as in previous years, and are pleased with the results achieved generally through the production of high quality catalogues. We have increased the emphasis on publications relating to politics, philosophy, economics and modern first editions where we have had a number of successful results.

We are also very happy to have renewed our lease at 32 St. George Street for a further five years. The property market in Central London has inflated in recent years but we have offset much of the increase in rent by licensing the third floor of the building to a third party.

Revenue for the year of £6.7 million (2015: £5.2 million) generated adjusted operating profit of £0.02 million.

Staff

As ever, our dedicated employees have contributed significantly to the restoration of operating profitability of the Group in the year and I would like to take this opportunity of thanking them again for their hard work and effort in what has been a challenging year.

Current Trading and Prospects

The business remains well capitalised with high quality stock and, at the year end, had net assets of £10.2 million including £1.3 million of cash. These are equivalent to 75.0p and 9.5p per ordinary share respectively.

Despite a pleasing performance in the year ended 31 March 2016 compared with the previous year, we are aware of the requirement to make better returns from our strong asset base. We continue to seek opportunities for organic growth and to encourage bright and knowledgeable people with specialist knowledge of their markets to join us.

The financial year started slower than expected: levels of activity in our core markets continued to be positive but, consistent with the broader experience of business confidence in the UK leading up to the UK referendum on EU membership, our customers delayed material discretionary purchases. In the current year, we hope increased marketing in international venues, including the US, will enable us to benefit from weaker Sterling. We are also pleased to note that interest and activity in our Russian department has started to return.

Jasper Allen

6 July 2016

Strategic Report

This report provides an overview of our strategy and of our business model; gives a review of the performance of the business and of our financial position at the year-end; and sets out the principal risks to which the Group is exposed. In addition it comments on the future prospects of the business.

Principal Activities & Review of the Business

The Group is engaged in the business of fine art and collectibles. It is typically engaged as a dealer — buying, owning and selling rare & collectible items objects for a profit. It does this on its own or alongside third party dealers in rare and collectible goods.

Shapero Rare Books is the core of the Group. It is a leading international dealer in rare and collectible antiquarian books and works on paper with special expertise in Natural History, Russian and Travel books. It is also developing its Shapero Modern brand which deals in modern and contemporary prints and editions by better-known artists who already have commercial success.

Scholium Trading is the newest member of the Group. Based upon recognition that art dealers are often undercapitalised, it works alongside these dealers in the broader rare and collectibles market where they have the expertise and the clients, but not the capital, to trade in their markets.

The Group maintains value from ownership of its stock and generates value through its expertise, astute buying and the profitable sale of stock.

Strategy & Key Objectives

The Company is seeking to grow its businesses organically through reinvestment of profits in high quality stock. Our key objectives are to:

- Increase the profitable trade of Shapero Rare Books and Shapero Modern through increased sales, selective purchasing and management of the cost base;

- Develop Scholium Trading to be the ‘first call’ for dealers in high value rare and collectible items seeking support in their trading items which exceed their immediate financial capacity; and

- Seek to expand the group by encouraging new teams — that have specialist expertise in their markets and are seeking a well-capitalised company from which to trade — to join Scholium.

Review of the year from continuing operations

The Group had a welcome return to operating profitability (before exceptional items of expenditure) in the year. Revenue increased by 30.5% to £6.8 million as a consequence of stabilisation in our core market and increased revenue and profits from new initiatives and the development of recently established departments.

Shapero Rare Books and Shapero Modern continued to provide valuable revenue streams, and we are happy with the support we have been able to give our market through Scholium Trading, where much of the trade has taken place amongst dealers known to us through our core books and works on paper expertise. Our current principal KPIs are:

- Gross margin, EBITDA, earnings per share;

- The breadth and distribution of the stock of assets held by the Group;

- Stock turnover of assets; and

- Various key risk indicators including capital resources, portfolio allocation and cash.

Key Performance IndicatorsYears Ended 31 March (all figures ‘000) |

2016 | 2015 |

Variance |

|

| Revenue | 6,742 | 5,166 | +30.5% | |

| Gross Profit | 2,376 | 1,893 | +25.5% | |

| Gross Margin | 35% | 37% | -1.4% | |

| Stock Turnover (months) | 20.64 | 22.25 | +7.2% | |

| Gross Yield | 32% | 31% | +0.4% |

Both Shapero Rare Books and Scholium Trading achieved profitably through the year. Encouragingly, stock turnover dropped to 20.6 months (2015: 22 months) and the gross profit as a percentage of the average stock levels increased to 32% (2015: 31%). Gross margin reduced to 35% (2015: 37%) reflecting, in large part, a desire of management to generate increased profits at slightly lower margins.

Analysis of revenue and profit by department

Year ending March 2016 (all figures £’000)

Shapero Rare Books |

Scholium Trading |

Central |

Consolidated |

|

Revenue |

5,609 |

1,133 |

0 |

6,742 |

Gross Profit |

2,172 |

204 |

0 |

2,376 |

Gross Margin |

39% |

18% |

n/a |

35% |

Adjusted Operating Profit |

192 |

188 |

-356 |

24 |

The business achieved growth across all business units. Shapero Rare Books’ revenue grew to £5.6 million (2015: £4.4 million) delivering operating profit of £0.2 million (2015 loss of £0.2 million). Gross margin in the year dropped to 39% (2015: 41%) as the team successfully sought to drive profits through margin reduction.

As expected, Scholium Trading’s business increased during the year (profitability up by more than 50%) and it provided a valuable contribution of £0.2 million (2015: £0.1 million) to group profitability. The gross margin in Trading increased to 18% (2015: 13%). As expected, this is lower than the margin in Shapero Rare Books and reflects the payment of incentives to partners that the Group trades alongside.

Management also reduced central costs to £0.4 million (2015: £0.5 million). Overall, it is pleasing that almost all of our increase in gross profit has flowed to the bottom line.

Year ending March 2015 (all figures £’000)

| Shapero Rare Books | Scholium Trading | Central | Consolidated | |

| Revenue | 4,440 | 720 | – | 5,160 |

| Gross Profit | 1,800 | 90 | – | 1,890 |

| Gross Margin | 41% | 13% | 0% | 37% |

| Operating Profit | (130) | 90 | (483) | (523) |

Dividend

The Board does not propose to declare a final dividend for the current year.

Simon Southwood

Finance Director

6 July 2016

Independent Auditor’s Report to the Members of Scholium Group plc

We have audited the financial statements of Scholium Group Plc for the year ended 31 March 2016 which comprise the consolidated statement of comprehensive income, the consolidated statement of financial position, the consolidated statement of changes in equity, the consolidated statement of cash flows, the Company statement of financial position, the Company statement of changes in equity, the Company statement of cash flows and the related notes. The financial reporting framework that has been applied in their preparation is applicable law and International Financial Reporting Standards (IFRSs) as adopted by the European Union and, as regards the parent company financial statements, as applied in accordance with the provisions of the Companies Act 2006.

This report is made solely to the Company’s members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the Company’s members those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company’s members as a body, for our audit work, for this report, or for the opinions we have formed.

Respective responsibilities of Directors and Auditors

As explained more fully in the Directors’ Responsibilities Statement, the Directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view. Our responsibility is to audit and express an opinion on the financial statements in accordance with applicable law and International Standards on Auditing (UK and Ireland). Those standards require us to comply with the Auditing Practices Board’s Ethical Standards for Auditors.

Scope of the audit of the financial statements

A description of the scope of an audit of financial statements is provided on the FRC’s website at www.frc.org.uk/auditscopeukprivate.

Opinion on financial statements

In our opinion:

- the financial statements give a true and fair view of the state of the Group’s and the parent Company’s affairs as at 31 March 2016 and of the Group’s loss for the year then ended;

- the Group financial statements have been properly prepared in accordance with IFRSs as adopted by the European Union;

- the parent Company financial statements have been properly prepared in accordance with IFRSs as adopted by the European Union and as applied in accordance with the provisions of the Companies Act 2006; and

- the financial statements have been prepared in accordance with the requirements of the Companies Act 2006.

Opinion on other matters prescribed by the Companies Act 2006

In our opinion the information given in the strategic report and Directors’ report for the financial year for which the financial statements are prepared is consistent with the financial statements.

Matters on which we are required to report by exception

We have nothing to report in respect of the following matters where the Companies Act 2006 requires us to report to you if, in our opinion:

- adequate accounting records have not been kept by the parent company, or returns adequate for our audit have not been received from branches not visited by us; or

- the parent company financial statements are not in agreement with the accounting records and returns; or

- certain disclosures of Directors’ remuneration specified by law are not made; or

- we have not received all the information and explanations we require for our audit.

Ajay Bahl BA FCA (Senior statutory auditor)

For and on behalf of Wenn Townsend Chartered Accountants (Statutory auditor)

Date: 6 July 2016

Consolidated Statement of Comprehensive Income

| Year ended | Year ended | ||

| 31 Mar | 31 Mar | ||

| 2016 | 2015 | ||

| Note | £000 | £000 | |

| Revenue | 3 | 6,742 | 5,166 |

| Cost of Sales | (4,366) | (3,273) | |

| Gross profit | 2,376 | 1,893 | |

| – | – | ||

| Distribution costs | (345) | (268) | |

| – | – | ||

| – | – | ||

| Administrative expenses | (2,007) | (2,148) | |

| Group expenses/recharges | – | – | |

| – | – | ||

| Exceptional gains and losses | (24) | – | |

| – | – | ||

| Total administrative expenses | (2,031) | (2,148) | |

| Loss from operations | – | (523) | |

| Adjusted operating profit before exceptional gains and losses | 24 | (523) | |

| Exceptional gains and losses | (24) | – | |

| Loss from operations | – | (523) | |

| Financial income | 2 | – | |

| Financial expenses | (5) | (6) | |

| – | – | ||

| Loss before taxation | 4 | (3) | (529) |

| – | – | ||

| Income tax credit/(expense) | (3) | 29 | |

| – | – | ||

| Loss for the year from continuing operations | (6) | (500) | |

| Discontinued operations | |||

| (Loss)/profit for the year from discontinued operations | (10) | 24 | |

| Loss for the year and total comprehensive income attributable to equity holders of the parent company | (16) | (476) | |

| Basic and diluted loss per share: | |||

| From continued operations – pence | 6 | (0.05) | (3.71) |

| From discontinued operations – pence | 6 | (0.07) | 0.18 |

| Total loss per share – pence | 6 | (0.12) | (3.53) |

Consolidated Statement of Financial Position

| 31 Mar | 31 Mar | ||

| 2016 | 2015 | ||

| Note | £000 | £000 | |

| Assets | |||

| Non-current assets | |||

| Property, plant and equipment | 92 | 92 | |

| Deferred corporation tax asset | 7 | 277 | 280 |

| 369 | 372 | ||

| Current assets | |||

| Inventories | 7,550 | 7,471 | |

| Trade and other receivables | 2,034 | 1,694 | |

| Cash and cash equivalents | 1,309 | 2,122 | |

| 10,893 | 11,287 | ||

| Assets of disposal group classified as held for sale | – | 162 | |

| Total assets | 11,262 | 11,821 | |

| Current liabilities | |||

| Trade and other payables | 1,115 | 1,634 | |

| Total current liabilities | 1,115 | 1,634 | |

| Liabilities of disposal group classified as held for sale | – | 24 | |

| Total liabilities | 1,115 | 1,658 | |

| Net assets/liabilities | 10,147 | 10,163 | |

| Equity and liabilities | |||

| Equity attributable to owners of the parent | |||

| Ordinary shares | 136 | 136 | |

| Share Premium | 9,516 | 9,516 | |

| Merger reserve | 82 | 82 | |

| Retained earnings/(deficit) | 413 | 429 | |

| Total equity | 10,147 | 10,163 |

The financial statements were approved by the Board of Directors and authorised for issue on 6 July 2015.

Consolidated Statement of Changes in Equity

| Share | Share | Merger | Retained | Total | ||

| Capital | Premium | reserve | deficit | Equity | ||

| £000 | £000 | £000 | £000 | £000 | ||

| Balance at 1 April 2014 | 132 | 9,458 | 82 | 1,109 | 10,781 | |

| Loss for the year from continued and discontinued operations | – | – | – | (476) | (476) | |

| Total comprehensive income for the period | – | – | – | (476) | (476) | |

| Shares issued in the period | 4 | 58 | – | – | 62 | |

| Dividends paid | – | – | – | (204) | (204) | |

| Balance at 31 March 2015 | 136 | 9,516 | 82 | 429 | 10,163 | |

| Loss for the year | – | – | – | (16) | (16) | |

| Total comprehensive income for the period | – | – | – | (16) | (16) | |

| Balance at 31 March 2016 | 136 | 9,516 | 82 | 413 | 10,147 |

There were no transactions with owners in the year.

| The following describes the nature and purpose of each reserve within owners’ equity: | |

| Share capital | Amount subscribed for shares at nominal value. |

| Share premium | Amount subscribed for share capital in excess of nominal value less attributable share-issue expenses. |

| Merger reserve | Amounts attributable to equity in respect of merged subsidiary undertakings. |

| Retained earnings/(deficit) | Cumulative profit/( loss) of the Group attributable to equity shareholders. |

.

Consolidated Statement of Cash Flows

| 31 Mar | 31 Mar | ||

| 2016 | 2015 | ||

| £000 | £000 | ||

| Cash flows from operating activities | |||

| Loss before tax | (16) | (505) | |

| Depreciation of property, plant and equipment | 31 | 44 | |

| Amortisation of intangible assets | – | 8 | |

| Profit on disposal of discontinued operation | (8) | – | |

| 7 | (453) | ||

| Increase in inventories 1 | (79) | (2,930) | |

| (Increase)/decrease in trade and other receivables 1 | (337) | 102 | |

| Decrease in trade and other payables 1 | (514) | (1,639) | |

| Net cash generated from operating activities | (923) | (4,920) | |

| Cash flows from investing activities | |||

| Purchase of property, plant and equipment | (31) | (38) | |

| Disposal of discontinued operation | 146 | – | |

| Net cash used in investing activities | 115 | (38) | |

| Cash flows from financing activities | |||

| Proceeds from the issuance of ordinary shares | – | 62 | |

| Repayment of shareholder loans | – | (350) | |

| Dividends paid | – | (204) | |

| Interest paid | (5) | (6) | |

| Net cash used in financing activities | (5) | (498) | |

| Net decrease in cash and cash equivalents | (813) | (5,456) | |

| Cash and cash equivalents at the beginning of the year | 2,122 | 7,578 | |

| Cash and cash equivalents at the end of the year | 1,309 | 2,122 |

1 Adjusted for inventories, other receivables and trade and other payables held in disposal group as at 31 March 2015.

Notes to the Consolidated Financial Statements

1 General information

Scholium Group plc and its subsidiaries (together ‘the Group’) are engaged in the trading and retailing of rare and antiquarian books and works on paper primarily in the United Kingdom. The Company is a public company domiciled and incorporated in England and Wales (registered number 08833975). The address of its registered office is 32 St George Street, London W1S 2EA.

2 Basis of preparation and accounting policies

The consolidated financial information, which represents the results of the Company and its subsidiaries, has been prepared in accordance with International Financial Reporting Standards and IFRC Interpretations issued by the International Accounting Standards Board

The principal accounting policies applied by the Group in the preparation of these consolidated financial statements for the years ended 31 March 2015 and 31 March 2016 are set out below. These policies have been consistently applied to all periods presented.

The functional and presentational currency of the Group and the Company is pounds sterling. The financial information is shown to the nearest £1,000.

Revenue Recognition

Revenue for the Group is measured at the fair value of the consideration received or receivable. The Group recognises revenue for services provided when the amount of revenue can be reliably measured and it is probable that future economic benefits will flow to the entity.

The Group’s revenues from the sale of rare and antiquarian books and works on paper are recognised on completion of the relevant transaction. The Group’s commissions and other revenues are recognised when all performance conditions have been satisfied.

Inventories

Inventories are valued at the lower of cost and net realisable value. Cost incurred in bringing each product to its present location and condition is accounted for as follows:

Net realisable value is the estimated selling price in the ordinary course of business.

Operating profit and loss

Operating profit and loss comprises revenues less operating costs. Operating costs comprise adjustments for changes in inventories, employee costs including share-based payments, amortisation, depreciation and impairment and other operating expenses.

3 Revenue

| 31 Mar | 31 Mar | |||||

| 2016 | 2015 | |||||

| Group | Group | |||||

| £000 | £000 | |||||

| Sales of books and other stock | 6,727 | 5,057 | ||||

| Commissions | 15 | 81 | ||||

| Other income | – | 28 | ||||

| 6,742 | 5,166 |

4 Profit Before Taxation

| Profit before taxation is after charging/(crediting): | 31 Mar | 31 Mar | ||||

| 2016 | 2015 | |||||

| Group | Group | |||||

| £000 | £000 | |||||

| Depreciation of property, plant and equipment | 31 | 44 | ||||

| Amortisation of intangible assets | – | 8 | ||||

| Operating lease rentals | 338 | 312 | ||||

| Foreign currency losses | 1 | 8 | ||||

| Employee costs (note 7) | 1,015 | 1,009 | ||||

| Fees payable to the Company’s auditor (note 9) | 40 | 30 |

5 Employee costs including Directors

| 31 Mar | 31 Mar | |||||

| 2016 | 2015 | |||||

| Group | Group | |||||

| £000 | £000 | |||||

| Wages | 884 | 919 | ||||

| Compensation for loss of office | 24 | – | ||||

| Social security costs | 88 | 75 | ||||

| Pension costs | 12 | 12 | ||||

| Other employee benefits | 6 | 3 | ||||

| 1,015 | 1,009 |

6 Profit (Loss) per share

| 31 Mar | 31 Mar | |||||||

| 2016 | 2015 | |||||||

| Group | Group | |||||||

| £000 | £000 | |||||||

| Loss used in calculating basic and diluted earnings per share attributable to the owners of the parent | (6) | (500) | ||||||

| (Loss)/profit from discontinued operation | (10) | 24 | ||||||

| (16) | (476) | |||||||

| Number of shares | ||||||||

| Weighted average number of shares for the purpose of basic and diluted earnings per share | 13,600,000 | 13,498,165 | ||||||

| Basic loss per share from continuing operations (pence per share) | 0.05 | (3.71) | ||||||

| Basic loss per share from discontinued operations (pence per share) | 0.07 | 0.18 | ||||||

| Total basic and diluted earnings per share – pence | 0.12 | (3.53) | ||||||

All shares issued in the year ending March 2015 arose from the exercise of employee share options. For further information see note 23.

All shares shown above are authorised, issued and fully paid up. Ordinary shares carry the right to one vote per share at general meetings of the Company and the rights to share in any distribution of profits or returns of capital and to share in any residual assets available for distribution in the event of a winding up.

7 Deferred Corporation Tax

| 31 Mar | 31 Mar | |

| 2016 | 2015 | |

| Group | Group | |

| £000 | £000 | |

| Balance at the beginning of the year

Income statement Balance at the end of the year

The deferred tax asset comprises:

Origination and reversal of temporary differences |

(280) | (258) |

| Income statement | 3 | (22) |

| Balance at the end of the year | (277) | (280) |

| The deferred tax asset comprises: | ||

| Available losses | (280) | (283) |

| Other temporary and deductible differences | 3 | 3 |

| (277) | (280) |

Deferred tax is calculated in full on temporary differences under the liability method using the tax rates expected for future periods of 20%. The deferred tax has arisen due to the availability of trading losses The Group has unutilised tax allowances, at expected tax rates in future periods, of £370,000 (2015: £352,000) of which £280,000 has been recognised (2015 £283,000 recognised).

8 Post balance sheet date events

There have been no material events directly affecting the Group since the balance sheet date. The potential effect on the Group’s business of uncertainty arising from the UK referendum on EU membership is still being assessed by the Board.

9 Control

The company is controlled by a small number of shareholders, none of whom has overall control.

[1] Before exceptional costs